The stock market remains to be the focus of investors globally and very few organizations remain relevant and exciting as Apple. FintechZoom Apple stock analysis helps the investors to invest in the company due to its stability, innovation, and adjustable future prospects. This article offers a deeper view into Apple’s stock through the FintechZoom platform more so with the performance comparison of Alibaba (BABA), Palatir (PLTR), and Tesla (TSLA).

FintechZoom Apple Stock Performance Overview

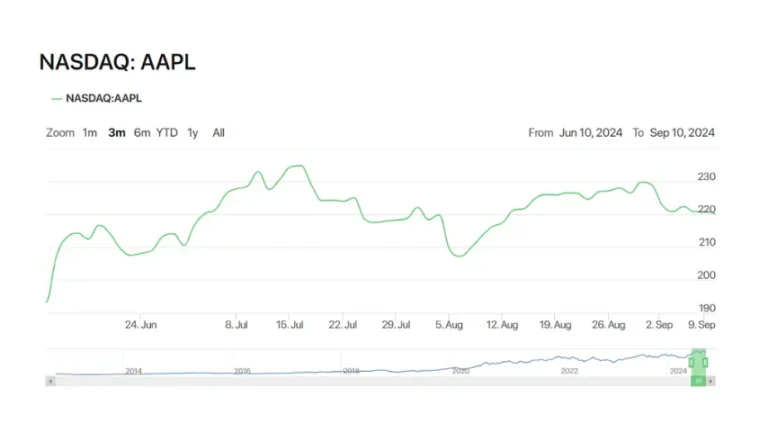

Apple Inc. has been a pioneer in technology investment and FintechZoom has also supplied information on the movement of the AAPL stock. That Apple has consistently delivered high returns is supported by two more factors: product differentiation and customer loyalty. A look at some of the events that occurred in FintechZoom shows how well it has performed despite changes in the market, especially because of its solid structures and well-informed product success specifically the iPhone and MacBook.

Apple’s product and service diversification is also why the company’s stocks are on the rise and the service segment is evolving over time. Apple earned over $ 383 billion in merchandising sales in 2023, with individual sales from iPhones according to the company’s 52% and product services such as Apple Music, and Cloud, according to the company’s 22%.

Accordingly, as services are expected to outpace the sale of hardware by 2025, as seen by FintechZoom’s analysis Apple is set to advance in the long term.

Apple Stock in Comparison to BABA, PLTR, and TSLA

Although Apple can still be strong in the field of tech stocks, the positions should be explored with other leaders such as Alibaba, Palantir, or Tesla, which have their own viable growth narratives.

1. Alibaba (BABA) Stock

Alibaba Group (BABA) mainly operates in the Electronic Commerce sector but has a well-developed Financial Technology sector in Ant Group. To illustrate, FintechZoom speaks about Alibaba’s possibility as interesting, especially given its focus on fintech with the help of AI and big data to support its services.

That said, geopolitical threats linked with the Chinese market and current regulation actions negatively reflect upon Alibaba stock and make it more unpredictable than Apple.

2. Palantir Technologies (PLTR) Stock

Palantir Technologies (PLTR) that offers data analytics as well as artificial intelligence solutions is another stock with high movement in the FintechZoom environment. In the recent past, Palantir was included in S&P 500 index, and its shares snapped more than 14 percent.

Palantir has attracted the attention of investors because of its government and enterprise contracts, despite the fact that sometimes the stock can go up or down depending on their contracts’ renewal and general market sentiment.

3. Tesla (TSLA) Stock

Tesla Inc. (TSLA), has been discussed widely at FintechZoom, its revolutionary electric cars, and renewable energy solutions company. Tesla’s stock has been on the rise with over 700% growth in the year 2020 compounded by diversification of products and venturing into new markets.

The beta of Tesla is greater than that of Apple primarily, we believe, because of the larger speculative elements in the company’s operations and the uncertain industry it belongs to, that is, the electric vehicles industry. But for the long-term speculators, Tesla is a stock that can skyrocket as the society moves toward embracing electric vehicles and green energy.

Why FintechZoom Apple Stock is a Stable Bet

As reported by FintechZoom, the Apple stock has been described to be capable of strong growth alongside maintaining steady returns. Even though Apple has increased its exposure to international opportunities and has recently embarked on expanding in services and health-related technologies, its risk profile is comparatively lower that companies such as Tesla and Palantir.

Alibaba has greater potential returns than other companies but it carries higher risks, particularly regarding relation with the Chinese political system.

Key Takeaways About FintechZoom Apple Stock

- Apple shows smooth revenue increase and making the strategies to achieve the goal, making it a good long-term investment.

- Alibaba has good growth prospects but in return has more risk simply because of the issues with the regulatory authorities.

- As such, it can be said that Palantir’s growth is tied to its contracts and AI dominance but is still considered more speculative.

- Tesla is one of the most intensive fluctuations of all car manufacturers but offers large potential profits to those who want to benefit from the growing production of electric cars.

Conclusion

In conclusion, FintechZoom Apple stock enables one to make conclusions not only regarding Apple and its performance but the tech industry as a whole. Nonetheless, each of the mentioned stocks has its own strengths: but the top tech giant Apple’s reliability and constant evolution make it the most attractive stock among others.

Further Reading: OpenHousePerth.net Insurance: A Comprehensive Overview